This screen enables Sell Currencies, Taxes, Revenue Account, Credit Limit, Payment Terms and Bank Account details to be set up for the agent.

Attaching a currency to the Debtor

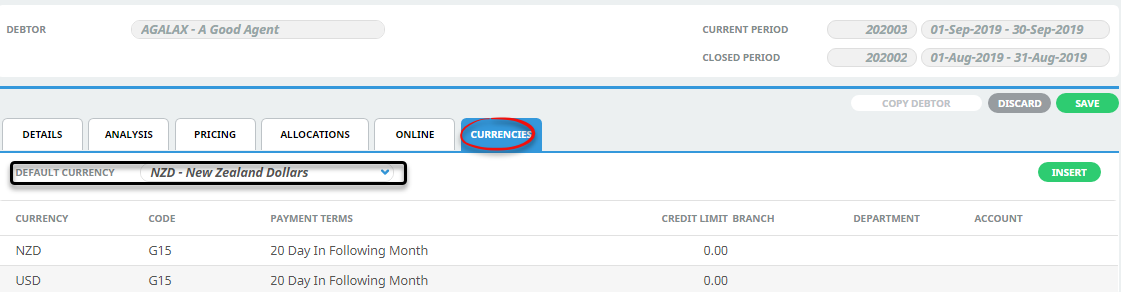

Default Currency (drop-down)

The currency that is defined in the default currency field has defaulted from when the Agent was initially inserted. If the default currency needs to change, choose the new default currency here and save the changes.

Additional currencies can also be inserted to make them available for an agents bookings to be costed and invoiced in.

Insert a new currency

- Make sure the currency to add is available (see the System Setup User Manual).

-

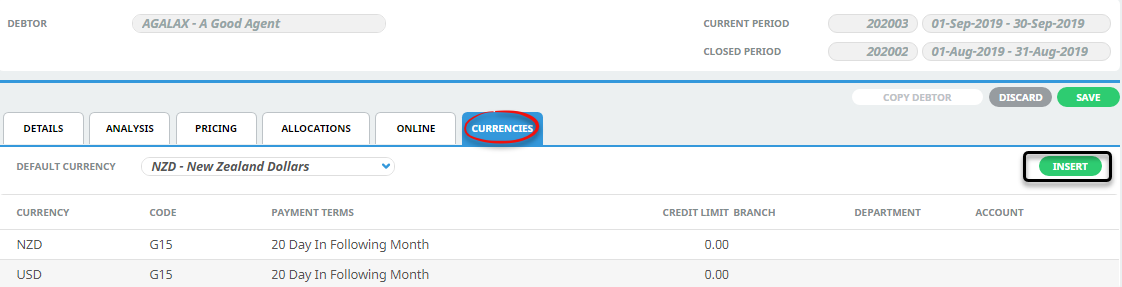

On the

Debtors screen (Currencies tab), click the green Insert button.

Debtors screen (Currencies tab), click the green Insert button.

-

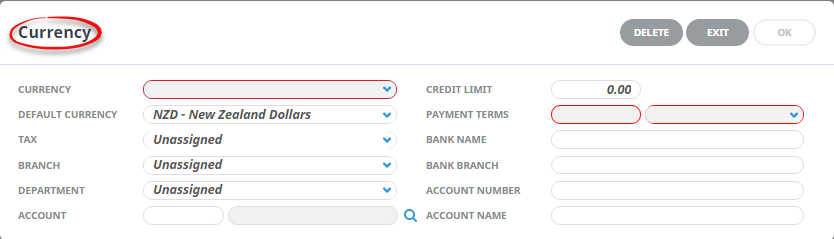

On the empty

Currency screen, choose a Currency from the drop-down list available and add Payment Terms (mandatory). Add information in the optional fields on this screen if known.

Currency screen, choose a Currency from the drop-down list available and add Payment Terms (mandatory). Add information in the optional fields on this screen if known.

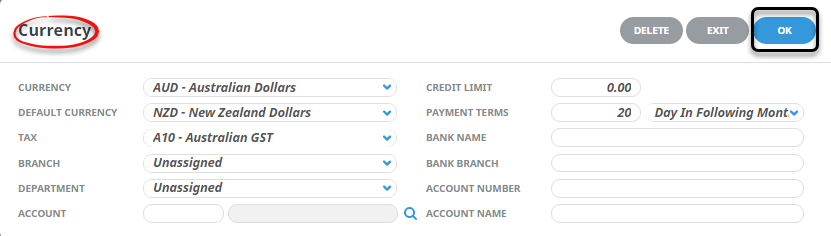

For example:

For example:

NOTE: Only currencies that do not already appear in the list under the Currencies tab are available in the drop-down Currency field. If all available currencies have already been chosen for this agent, then none will appear in the drop-down list.

-

Click

OK to keep the changes and save or update the entry.

OK to keep the changes and save or update the entry.

-

Click

Exit to discard any changes.

Exit to discard any changes.

About the Currency fields

Currency (drop-down)

Select the Currency being added.

Default Currency (drop-down)

The currency selected as the default currency will default into this field. If a different default currency is to be used, select it from the drop-down.

Tax

Available taxes that have already been set up in Code Setup are available from the drop-down list. To attach a tax, highlight it.

Branch / Department / Account (Drop-downs / Search)

These three fields can be used to attach a GL revenue account that all revenue generated by the Agent/Debtor can be posted to. This is only encouraged where the Debtor is not a Booking Agent—i.e., a sundry Debtor and will never be invoiced for bookings.

Credit Limit

A credit limit can be entered against the currency in this field. There can be different credit limits for each currency attached to the agent. If the agent does not have a credit limit, leave the field as 0.00. If a credit limit is entered, the amount of credit remaining can be seen in the Balances screen of the Agent.

- Warn that the credit limit is exceeded.

- Deny entry of the transaction/booking if the credit limit is exceeded.

- Allow entry of the transaction/booking after a password has been entered.

Payment Terms

There are two fields which make up the payment terms for the agent. The first is a numeric value which is either a) a number of days or b) a date in a month depending on which setting is chosen from the drop-down list in the second field. Combined these are used to calculate the payment due date of an invoice transaction. The available options are:

| Option | Description |

|---|---|

| nn days | Prior to Travel |

| nn days | After Travel |

| nn days | After Invoice |

| Day | In Following Month |

| Day | In Current Month |

| Day | In Month of Travel |

| Day | In Month After Travel |

Bank Name / Bank Branch / Account Name (30 chrs each) & Account Name (60 chrs)

These fields can be used to store the Agent/Debtor bank account details. The Bank Name, Bank Branch and Bank Account fields can be output on agent messages.

NOTE: There is no functionality in NX to automatically generate payments to agents. Payments can be made to agents by issuing a negative invoice offset by a negative receipt.

Supporting Information

See also Currency Columns from within Debtors or Creditors in the appendix.